The Income Tax Department Has Clarified That Existing PAN Cards Of Taxpavers And Individuals Are QR Code Under The New Pan Card 2.0 Project. Allotment Updation Or Correction Of PAN Will Be Done Free Of Cost And e-pan Will Be Sent to The Registerad Mail id. For Physical PAN Card , The application Has To Make A Request Along With The Prescribed Fee Of RS 50 (Domestion). For Delivery Of PAN Card Outside India RS 15 + Indian Post Charges At Actuals Will Be Charged For The AppliCant . According To The Income Tax FAQs, Though The PAN 2.0 Project Is Yet To Commerenty , Taxpayear And Individuals Currently Can Get Their PAN On Theri Email ID . If There Is On Email ID Registered In The Income Tax Database Under The PAN 2.0 Project For Free,

Step-by-step Guide To Apply And Get A New Pan Card 2.0 On Your Email

Before Applying To Get The PAN On Your Email, A Taxpayer Must Check Whether Their PAN Is Issued by NSDL Or UTI Infrastructure And Technology And Sevices Ltd .(UTIITSL) This Is Depending On The Issuer , A taxpayer Must Follow The Steps To get PAN On Email. Or Digital Form ,

Also Read :- Parivahan Sewa | Ministry of Road Transport | License & Registration Details

Important Links :

| NEW PAN CARD 2.0 WEBSITE | અહીં ક્લિક કરો |

| NEW PAN CARD 2.0 Online Videos | અહીં ક્લિક કરો |

Step TO Get New Pan Card 2.0 Form NSDL Website :

Step 1: Go to the link: https://www.onlineservices.nsdl.com/paam/requestAndDownloadEPAN.html

Step 2: On the webpage, enter the following information: PAN, Aadhaar (Only for individual), date of birth.

Step 3: Once the required information is entered, select the applicable tick boxes and click on submit.

Step 4: A new webpage will open on your screen where you must check your current details as updated with the income tax department. You will be asked to select the option where you wish you get one time password (OTP).

Step 5: Enter the OTP and validate the details. Remember the OTP is valid for 10 minutes.

Step 6: Select the mode of payment. Select the tick box for agreeing to terms and conditions. Select ‘Proceed to Payment’ option.

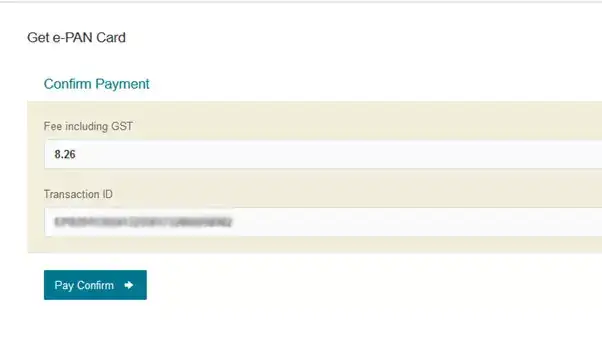

Step 7: Check the payment amount and select ‘Pay Confirm’.

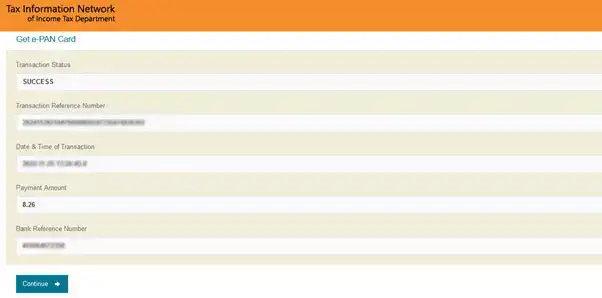

Step 8: Once the payment is made, click on continue.

Step 9: Once the payment is successful, the PAN will be delivered to the email ID as updated in the income tax database

It can take up to 30 minutes to receive the PAN on your registered email ID. If you do not receive the PAN on your email ID, you can send an email to tininfo@proteantech.in with the payment details. Alternatively, taxpayer can also call their customer care at 020 – 27218080 or 020 – 27218081.